Nurses play an important role in health promotion and delivery of care. They practice in a variety of settings, from hospitals and clinics to elder homes and community health centers. Conducting physical exams, counseling, education, and organizing patient care are all part of this job.

The responsibilities of a typical registered nurse are diversified. Things may sometimes get confusing. As a result, there is a certain amount of legal and financial danger. Thankfully, you have a variety of insurance options to choose from, all of which provide protection when you need it. What kind of insurance does a nurse require?

Health Insurance

Health insurance is required for everyone. You need health insurance regardless of your age, gender, or nationality. Health insurance, like automobile insurance, protects you if something goes wrong with your car. Your health insurance coverage will protect you when you’re sick or hurt.

Likewise, it covers the insured's medical and surgical expenses. Because of plan limitations addressing in- and out-of-network providers, deductibles, copays, and other factors, selecting a health insurance plan can be difficult.

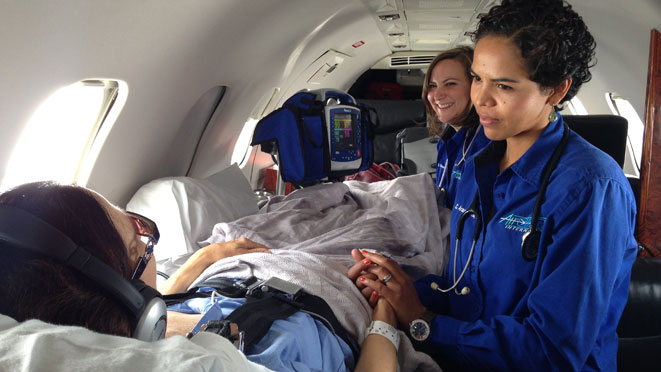

Travel Health Insurance

Travel nurses' health insurance and benefits may become even more complicated. The majority of travel nurse agencies offer affordable health insurance. However, this insurance may only apply while you are on the job, which could make you nervous if you are in between jobs.

Using the insurance supplied by your travel nursing agency can make the process go much more smoothly. It's less expensive and time-consuming than shopping for your health insurance, and most agency policies provide extensive coverage and access to economies of scale.

Liability Insurance

Nurses must have liability insurance. Nobody likes things to go wrong, so liability insurance can protect you and give you peace of mind if they do. While most workplaces provide medical malpractice insurance to nurses, you should consider getting your personal liability insurance.

Life Insurance

After you pass away, the proceeds from your life insurance policy might be utilized to help pay for last expenses. Burial or cremation costs, any outstanding medical bills not covered by insurance, and estate settlement costs are examples. Your beneficiaries are free to spend the funds for whatever they like.

There are different types of life insurance: term, whole life, and universal life insurance.

Term Life insurance

This type of insurance is simple and low-cost. It is a fantastic choice for almost all employees since it delivers the benefits that the majority of people require without the frills that they do not. Term life insurance, as the name implies, is for a specific period, such as one year, ten years, twenty years, or more. Beneficiaries receive a payout or death benefit if the insured dies while covered by term life insurance. If the insured person dies after the term has elapsed, however, there is no reimbursement.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that pays out for the rest of the insured's life as long as the premiums are paid on time. This form of insurance is worth getting as soon as possible because it often includes a savings component that can grow over time. If you play your cards well, you can use this for significant purchases like property deposits.

Universal Life Insurance

You can get lifelong coverage with universal life insurance. The death benefit, or payout from a life insurance policy, is paid to your beneficiaries tax-free. Some universal life insurance policies also accrue cash value, which grows tax-free. Universal life insurance policies rise in value over time and are tax-free. Depending on the policy, you may be able to change your premium payments and death benefit.

It is a personal decision whether or not to purchase life insurance. Nurses should be aware of their employer's coverage as well as their policy on private insurance holders. Some workplaces forbid nurses from having private insurance. Nurses should also be aware of what their private insurance coverage covers. Knowing what policies cover will aid nurses in navigating a stressful and difficult situation.

Explore healthcare jobs here: https://jobs.1nurse.com/

Easier access to jobs through the app 1NURSE Mobile App